I have to admit, when, at the peak in February, our investments reached $1,071,XXX, I thought to myself, “We’re probably safely above a million now.” I’m a fairly superstitious person, but I am pretty sure that I didn’t knock on wood, and April made me regret it.

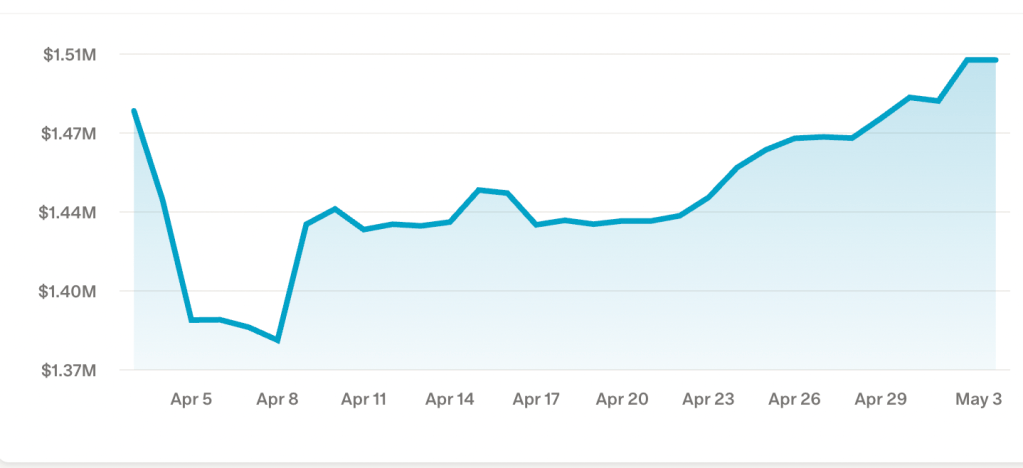

I don’t usually show the monthly chart of our net worth, because I only really care about the numbers at the end/beginning of the month, but phew, last month was a roller coaster.

We started off below that $1.5MM mark I celebrated back in March, but no big deal, we were’t too far off. Then the tariff drama continued and we dropped, and dropped, and dropped, and dropped. Our investments never reached $8XX,XXX, but we did go as low as $939,XXX in that trough, which was dismaying. I again found myself wanting to reduce my MBDR to make faster progress on paying back some of the money we’ve borrowed from ourselves, but kept reminding myself of the value of holding still. I changed nothing, and it started to recover. We regained our second comma, and I still changed nothing. It’s now May 3rd and it’s like the month of April never happened to the stock market – in fact, we ended up for the month on all the accounts we contributed towards during the dip.

As I said elsewhere, this past month was a great reminder that making immediate decisions based off short-term data is a bad choice. I’m glad I changed nothing. And despite changing nothing, we were actually able to contribute $625 extra to our vacation fund this month, plus another $260 to our general deficit, so the cost-cutting I mentioned in the post about standing still is working!

| Category | May 2025 | Change |

|---|---|---|

| Savings | $103,542 | -5.7% |

| Investments | $386,052 | -0.3% |

| Cars | $69,151 | -2% |

| House | $605,068 | +1.3% |

| Retirement | $668,366 | +1.8% |

| Mortgage | -$347,862 | -0.2% |

| Credit Cards | $0 | 0% |

| Net Worth | $1,484,317 | +0.8% |

| Invested Assets | $1,054,418 | +1% |

Our cash savings took a double hit this month – first, we paid our taxes, which required pulling the $2,098 I had already set aside plus another $260 (the one we replaced almost immediately). Then, we had to pay off the $3,000 vet bill for our elderly cat having multiple teeth removed in March. Odds and ends closing out travel expenses covered the rest of the drop, but it should go back up this month with my stock vest refilling several of the buckets.

As I write this, May 2nd delivered another excellent day in the stock market, so we’re back up over $1.5MM. This time, we’ll have to remember to celebrate.

Leave a comment